A Crypto Example: The Carnival

I intended to write this in 2017. After researching Bitcoin in 2013, news articles starting catching my and pulled me more deeply into the cryptocurrency world. The Bitcoin white paper was a fun read and good inspiration for dreams. Then in 2015, Ethereum was launched. It added smart contracts on top of blockchain technology, creating an entirely new horizon of possibilities.

Still, it wasn’t clear to me whether nor how cryptocurrencies could potentially change how value is created or measured. If one reasonable example could be found, maybe the future of the tech could be a bit more interesting.

The Carnival is the example that gave me the clarity and conviction to invest in 2017, invest more in 2021, and prepare again for the next cycle.

The Carnival is purely hypothetical. It uses the example of a carnival to illustrate concepts that suggest cryptocurrencies might enable novel ways to create and capture value.

Let’s explore.

The Carnival’s Goal

Our carnival isn’t so special. It endeavors to make rides, games, food, shows and other entertainment for paying customers.

While there are new types of business available to web3 participants, our carnival is quite normal and familiar.

The Cryptocurrency

The Carnival will utilize a cryptocurrency under the ticker symbol $PLAY. This is a normal cryotocurrency. It can be owned by anybody. Ownership is cryptographically secured by the blockchain. Anyone can buy or sell tokens on a publicly available exchange.

The Carnival “mints” exactly 10,000,000 $PLAY tokens. There will never be more (in this example).

Ride and Game Operators

The Carnival doesn’t operate its owns stalls. It chooses to invite other independent businesses to operate their rides and games inside The Carnival. You could build and operate a roller coaster while I run a nacho stand.

Common services are provided by The Carnival, including restrooms, waste management, utilities, etc.

Guests and Ticketing…err Tokening

Lots of families and friends are going to hear about all of the thrilling rides and tasty treats. Make no mistake – some of the rides and shows will be absolutely irresistible!

Guests line up out side the gate. As they walk up to the ticketing counter, they choose how many tokens (tickets) they want to buy.

On the first day, 100 $PLAY tokens cost $10 USD. $0.10 USD per $PLAY. Remember that number – it’ll come in handy in a bit.

There’s a big fence around the carnival grounds. Every ride, game, food stand or show within the big fence accepts only $PLAY tokens.

The roller coaster asks for 5 $PLAY tokens per ride. A bunch of guests ride the roller coaster, handing over a total of 5,000 tokens to the ride operator, Bob. Bob now holds the 5,000 tokens. $500 USD worth. Not a bad first day!

Warming Up

Over the next few weeks and months, more guests come. Bob continues to collect $PLAY tokens. He’s up to 100,000 tokens! He’s glad he got in early.

In that time, all of the tokens have been sold to guests. All 10,000,000. The Carnival itself has pulled in $1,000,000 USD. They gave out “magic internet money” that cost them nothing. Seems like a good deal The Carnival! Sold made-up crypto, pulled in $1,000,000 cash, and spent some of it maintaining the grounds.

Meanwhile, it’s not just Bob and the other initial operators providing entertainment. As more guests have piled in, more operators have shown up and set up. There’s now 20x more rides and games!

More entertainment options means more guests, too! There are also 20x more guests coming to the park each day!

This is good and bad for Bob. He has more guests and more competition. He needs to up his game, slowly fade away, or sell out.

The Next Phase: Token Appreciation

The ticket stand sold all of their tokens. Now what?

The ticket stand is no longer just a sales counter. It is also now an exchange. It’s job is to facilitate guests’ ability to buy. Good news! Technology does it for them. They just take the guest’s cash and the app does the rest.

Where do the tokens come from if The Carnival doesn’t have any left?

From Bob and the other operators.

Bob wants USD that he can spend in other parts of his life, outside of The Canival’s big fence.

Bob has tokens he is willing to sell. There are guests lined up who want to buy them.

As more guests want to get into The Carnival, demand for $PLAY is going up. More people want it!

For the same $10, guests can no longer get 100 $PLAY. There’s way more demand fornthe token, and Bob isn’t going to sell cheap. One $PLAY is now $0.15 USD. $10 now only buys 65 tokens.

Appreciation is Healthy

Guests actually don’t mind that they get 65 tokens instead of 100 tokens for that same $10.

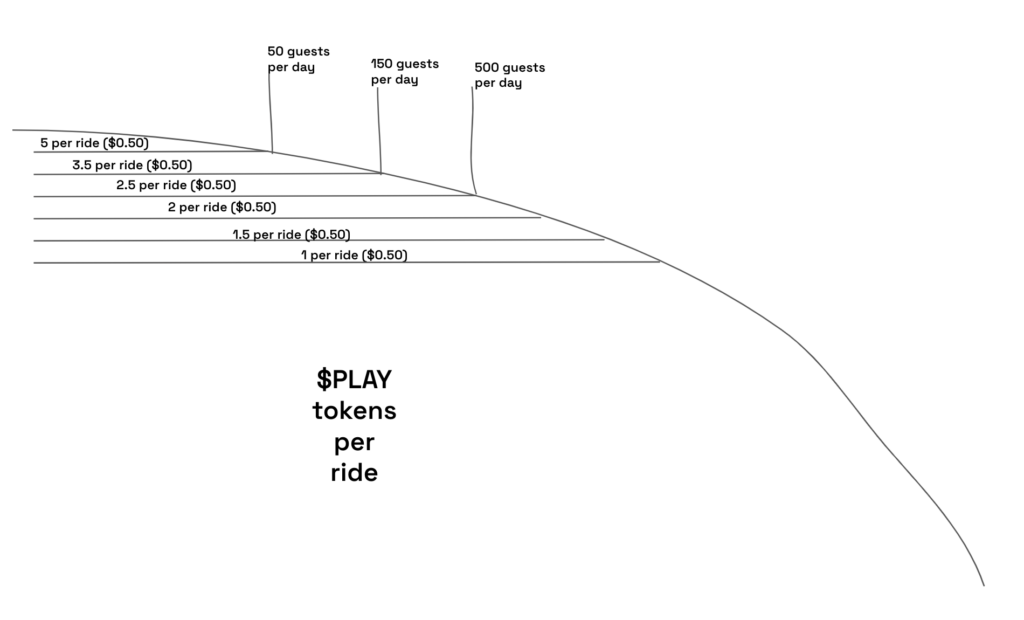

Bob used to charge 5 tokens, or $0.50, per ride. He’s OK with that. He doesn’t think guests suddenly want to pay $0.75.

Instead if charging 5 tokens, Bob has adjusted his license to 3.5 tokens so it’s still $0.50 USD to hop on the roller coaster.

Guests are getting the same rides for the same price they always were.

Appreciation Builds Wealth

So far, we’ve seen a pretty normal carnival grow. They’ve added rides and games, more guests are coming every day. Prices haven’t increased, though the value of a $PLAY token has.

What is Bob to do? Bob has been a responsible small business owner. He has been selling some tokens each week to take profits in USD. He’s living good and building USD savings. He also saw The Carnival growing, and thinks they’re on to something. So he held some $PLAY tokens, as well. In that first week, he was getting 5 tokens per ride worth $0.10 each. As the park has grown, the tokens are now worth $0.15 each. The “magic internet money” Bob earned in week 1 is worth 50% more than when we received it.

One of the week 1 guests, Alice, enjoyed The Carnival with her friends. She knew she would keep coming back and she believed it would grow. When she bought $PLAY tokens at $0.10 USD, she didn’t use all of them. She kept a bunch. Now her tokens are also worth 50% more. She amassed wealth by buying early and holding. Bob’s roller coaster is also no longer 5 tokens to ride. It’s only 3.5 now. Alice bought those tokens a long time ago. She paid $0.35 USD for enough tokens to ride. Her friend, Jared bought tokens today and paid $0.50 to ride.

It’s worth mentioning that Bob and Alice, as investors will learn to monitor hype cycles to maximize their investment.

Operations vs Investments

I’m this example, investors have financially benefited from The Carnival’s success. At the same time, guests have benefited from an increasingly better experience without paying more to enjoy it. The interests of guests and investors are not in conflict.

Furthermore, there’s a direct link between the “utility” of the $PLAY cryptocurrency and its market-traded price. The more it’s used, the more its (generally worth).

Investors aren’t concerned with The Carnival’s margins as primary investment KPI. The most important thing to evaluate is whether The Carnival is providing a useful ecosystem for operators and guests. If it works for everyone, utility goes up, and wealth builds.

Usefulness becomes the primary KPI.

Does The Carnival Make Money?

In this example, The Carnival doesn’t need to profit. It needs enough money to pay for staff to maintain the grounds. There’s plenty of financial incentive for the operators to continue providing a fun experience.

Maybe it wants to make money anyway.

If The Carnival makes money, it can prepare to sustain through difficult times, it can upgrade the grounds, and it’s operators can also build wealth along with everyone else.

The Carnival chose two ways to make money.

First, they actually didn’t sell all 10,000,000 $PLAY tokens. I hid information to keep things simple. They held 2,000,000 of them. They sell a few tokens here and there to grab some USD to pay bills. They sold a few for $0.10 each, then layer sold a few more for $0.15 each, and in a few months they’ll sell some more for $0.50 each. As The Carnival grows, and tokens appreciate, they sell fewer $PLAY each month while pulling in more USD, allowing them to sustain this income model for a long time.

The Carnival also wants to accumulate more $PLAY so they don’t run out. They charge a “swap fee” when Bob or Alice sells their tokens to a guest at the gate via the exchange. More guests means more $PLAY for The Carnival for them to sell later at a higher price.

In web3 today, it’s a popular move to give control of The Carnival to a DAO, allowing anyone holding tokens to have a say in how the park is operated.

It Starts to Make Sense

in 2017, this was enough for me to realize there’s something to all of this. It was enough for me to participate in 2018, 2021, and to continue to participate.

Tying this to the web3 space, we can roughly equate concepts as follows:

- The Carnival = Ethereum Blockchain

- $PLAY = $ETH

- Rides & Games = dApps

With the above mapping, an investor can choose to invest in $ETH (the ecosystem) or dApps (specific businesses inside the ecosystem).

This example doesn’t cover all of the bases. There are both optimizations and flaws in this model. More importantly there are tens of thousands of people experimenting with similar models and improving them every day.

New technology, like NFTs, continue to emerge, too. Each technological advancements opens a new door to a new world of models to experiment with.

It’s safe to say that The Carnival is just the tip of the iceberg.

(Featured image created using DALL-E A.I.)