Hidden Meta: Quantifiable Real-World Value Accrual

There’s a lot of blockchain projects out there. Thousands or more. It takes a lot of personal attention and community cooperation to take account.

A cooperative community scans broadly across several sectors to curate viable research opportunities. Personal attention generates deep understanding and evolving intuition. And community cooperation bookends the research with critical commentary.

This model works towards a number of goals – identifying investments, prioritizing sectors, and more. The most interesting goal, for me, is extracting meta.

Extracting Meta

“meta”: hidden patterns that are obfuscated by surface-level attributes

That’s my own definition. It’s properly reflective of how web3 communities seek a market edge – be that edge in investing, job hunting, entrepreneurial, etc.

Here’s a couple sports analogies to explain:

- In basketball, Shaq and Tim Duncan dominated the NBA for years. Eventually, teams started beating them. “Small ball” and 3-point shooting talent became the new meta.

- In football, Emmit Smith and Jerome Bettis hammered defenses into oblivion for years. Defenses stacked their roster core with big strong linebackers to meet theses powerful runners head-on. Some offenses noticed the defensive shift and began rostering small, quick, receiving running backs that the heavy linebackers couldn’t match speed or quickness with.

Teams who spotted the meta first built their new-age rosters quickest and gained enduring advantage.

Our Object of Interest: Bittensor

There are two massive emerging technologies front and center right now. Both show tremendous promise and both have glaring concerns. A beautiful ecosystem of potential and chaos. A land of opportunity where we choose to reduce risk, waiting for things to organize, or increase risk, diagnosing the organization efforts real-time to find a market edge. web3 and artificial intelligence.

A fantastic environment to identify and extract meta.

Let’s examine Bittensor to establish a baseline understanding. Then we’ll isolate the meta so we can use it elsewhere.

Bittensor is a blockchain focused on A.I.

That’s a big scope.

Creating entirely new ways for the world to work requires both a directionally correct initial hypothesis and a willingness to change that hypothesis based on reality.

Chainlink Founder Sergey Nazarov

Bittensor has an initial hypothesis. Time will tell if it is directionally correct.

Getting a Baseline Understanding

The initial hypothesis: “We can incentivize A.I. model improvements at a reduced cost and increased velocity. This will create a positive flywheel centered around the Bittensor blockchain that drives value back to the ecosystem and it’s token, $TAO.”

The later stages of their plan (the positive flywheel) are intended to result in usable A.I.-driven applications. Those will be direct competitors to Copy.ai, Jasper, DALL-E, etc.

Let’s set the future aside for a moment.

The initial stage is to:

- (a) incentivize A.I. model improvement

- (b) at a reduced cost

- (c) and increased velocity

(a) Model improvements are ongoing, driven by community members in exchange for $TAO. Bob improves an A.I. model on Bittensor’s network. The contributed intelligence (measured by a standard loss function) is measured. Bob is awarded $TAO. We see incentivized model improvements.

(b) It’s generally understood that tens-or-hundreds of millions of dollars were spent training GPT-3 to get it where it is today. It’s extremely expensive to start-up an A.I. business that generates it’s own intelligence from scratch. Bittensor has presumably raised only a tiny fraction of capital. They don’t pay A.I. modelers in USD. They pay them in fake internet money. Reduced cost? Pretty close to $0 since Bittensor doesn’t pay anything to generate $TAO and give it to Bob.

(c) Reportedly, Bittensor community members have built up the neural network to a scale reportedly larger than industry-leading GPT-3. It’s difficult for me to validate the quality of the accrued intelligence. If we assume the quality is at least mediocre, and that quality is something that can itself be incentivized, I’m ok with that. The velocity was the thesis and it’s proven.

Closing an Important Loop

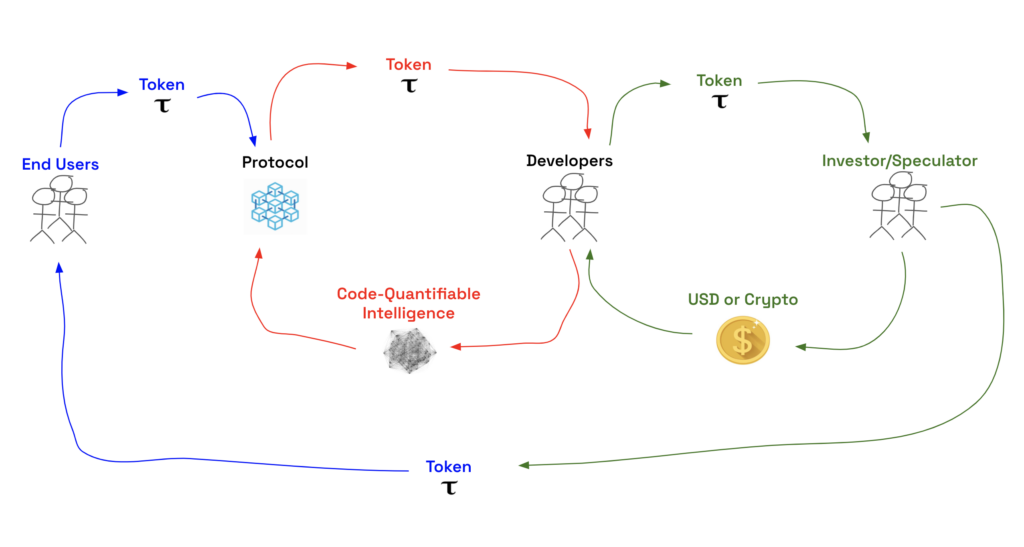

As with most crypto-centric projects, a cryptocurrency is the center of the incentive structure.

If $TAO costs nothing to create, why would anyone want it as their reward?

- the token is required to query the network (instead of paying a fee, you stake tokens to gain access to, for example, APIs)

- tokens give “voting power” to influence the networks operations and policies

- people invest in the potential of the above bullet points by buying $TAO from willing sellers

A.I. developers train models, receive $TAO, and sell it to investors. Many have quit jobs at A.I. companies to work on their own terms earning $TAO.

I won’t speculate on if that’s a good idea, or if it’s lucrative or any of that. This isn’t investment advice. We’re hunting meta.

Competitive Advantage Worth Noting

Traditional businesses have a massive cost tied to increasing model intelligence. Bittensor’s cost is $0.

If the thesis is directionally correct, and if there’s a chance that real products can be built on the network, it could be hard for traditional businesses to compete.

The Meta

Finally! Let’s back out away from the trees. Let’s take a higher vantage point and observe the forest.

Meta #1: A New Compensation Structure

A traditional business requires either cash or equity to incentivize contributors.

Starting with cash is difficult. Someone needs to take the financial risk to front the cash.

Starting with equity is difficult. It’s illiquid and restrictive. Even after vesting, there’s rarely a market to sell into.

Compensation via tokens resolves both issues. Nobody needs to take on financial risk. Tokens are instantly liquid, pending vesting terms.

Additionally, it’s simple to reward contributions when using tokens. In the example of Bittensor, it’s coded right into the business itself. The code handles everything – no need for audits, approvers, distributors, etc. It’s automated out of the box.

Meta #2: Accrued Quantifiable Real-world Value

Before we go into this one, let’s make an observation. Production cost matters. Gold has a production cost – the cost of mining. While gold also has practical uses, the production cost is a clear consideration when the market prices the commodity. Gold miners need to make certain margins to feel confident staying in the game. If they could lower costs and maintain margins, they would purely from a competitive standpoint. The production cost, however, supports a certain price floor. If buyers are willing to pay the production cost plus a margin, the market thrives. This gives gold holders some added confidence, knowing that gold miners are unlikely to lower the cost of the commodity. They have to cover production costs at a minimum.

Bitcoin is similar in terms of production cost. Miners have a real production cost in terms of the electricity (and management overhead) required to mine Bitcoin. This creates confidence in holders that miners won’t dump their bitcoin below a certain price – namely, a price equal to the production cost.

If buyers don’t value gold, and price drops below production cost, the market implodes. Seems unlikely given the real world uses for gold. If buyers don’t value Bitcoin, and price drops below production cost, the market implodes. This is possible. There isn’t an express use for Bitcoin.

Herein lies the meta of Accrued Quantifiable Real-world Value.

Using Bittensor only as one example, it is accruing A.I. model intelligence. The intelligence has real world use, as demonstrated by the plethora of A.I. products who are paying for OpenAI’s intelligence, repackaging it, and selling use-case-driven products like Copy.ai. Similar to jewelers and electronics manufacturers who buy gold, repackage it, and sell it as necklaces or mobile phones.

This A.I. intelligence also has a quantifiable production cost. There’s a clear and observable cost to operating GPUs to process A.I. training processes. There’s a clear cost to the time and talent of a developer who knows how to configure and evolve the training process.

Summary

The meta here is clear. I’m looking at protocols that accrue real-world value in a code-quantifiable way. And I’m looking specifically at ones that carry both a known production cost and a human-talent production cost – the combination creates a moat. The amount of money and time required to catch up to an incumbent like OpenAI (you can imagine similar in other fields and sectors) is immense. This meta generates incentivized and aligned velocity and scale that might catch incumbents and set a pace that would take even more time and money for someone else to catch.

Meta has been identified and extracted.