Recent Revenue Models in web3

Not in it for the metaverse. I’m not even in it for the tech.

I’m in it for the models. For new ways to create, measure and exchange value.

One tiny part of that is observing ways value is captured.

Here’s a summary of a few of the basics we’ve seen over time and how it’s evolving in web3. There’s so much more, too. I’ll cover others as we go.

The evolution of digital commerce revenue capture, starting from the 90s internet:

0️⃣ Call-to-Buy

Is this even digital? 😳

Believe it or not, there was a time before an order could be capture on “the interweb”. In the 90s, I wrote a custom credit card encryption routine because Stripe didn’t exist yet. And wouldn’t for a long time.

1️⃣ Fixed Price Sales

The good ole standard set by Sam Walton himself. He was a big proponent of having the inventory ready, setting a fair price, and clearly displaying the price to shoppers.

It’s no surprise this model became popular and made its way online. It’s still the defacto.

2️⃣ Fees

Credit cards are famous for it. As digital payment processors innovated, more and more adopted the fees model. Shippers, too.

Place your fixed price order. And pay this fee while you’re at it. Pretty effective to monetize services that improve the buying experience.

3️⃣ Variable Price Sales (auctions etc)

While Walton helped pull us out of the haggling era, fixed pricing isn’t always optimal. But people still largely hate haggling.

Enter online auctions, where supply and demand get to date before they get married.

Exotic variations like reverse auctions and Dutch auctions also found homes.

4️⃣ Bundles & Add-Ons

Buy a gaming console and get a game! Just pay us a bit more…but we know you want both!

GoDaddy and VistaPrint mastered the bundling model by stretching it out into multiple “… and this! … and this!” add-ons inserted into checkout flows.

5️⃣ Subscriptions

What’s better than someone buying your product? Them forgetting that they agreed to buy it again!

6️⃣ Micro-transactions

Popularized by digital games. Since the cost of a digital good is near-zero, and $0.10 doesn’t feel like a big purchase, sellers capitalize by driving a high volume of tiny transactions.

7️⃣ Bonding Curves

web3 provided one of the more recent meaningful advancements, popularized by Euler Beats in 2021. The first buyer gets 1st price, the second buyer pays a bit more, and each subsequent buyer pays a little more. The creator makes exponentially more if the project sells more while distributing a lower supply.

Observers saw this model change the hype curve a bit. Buyers would rush in to get early pricing, generating momentum and getting people to buy at higher prices, setting a higher market value. Sucks to be the buyer ‘at the top’. Congrats to the earlies!

In a fixed price sale, the secondary market pumps and dumps as people compete split-second to buy before the next person. Bonding curves slowed that cycle down a little bit. There was more predictability regarding the balance of supply and demand. When there’s a bit more data to consider, buying tends to slow down a bit. This ever so slightly tips the scales from emotion buying into a bit more contemplative buying.

8️⃣ Secondary Royalties

In web3, it’s possible to attribute a % of secondary (person-to-person) sales back to the creator of the digital item.

Imagine if My Little Pony got 5% of those toys that sold at that garage sale. Pretty cool.

When a creator sells items for a fixed price or otherwise, motivating consumers to continue buying and selling to each other generates sales volume, with a % of it being a new and infinite revenue stream.

Unioverse, founded by a former Nintendo exec, intends to build an entire gaming ecosystem without selling a single thing after 1 initial sale. They’ll run their entire business as long as they can only on secondary royalties. All new items funnel through first-sale buyers and they then supply the market. Unioverse just takes secondary royalties.

9️⃣ Liquidity Fees

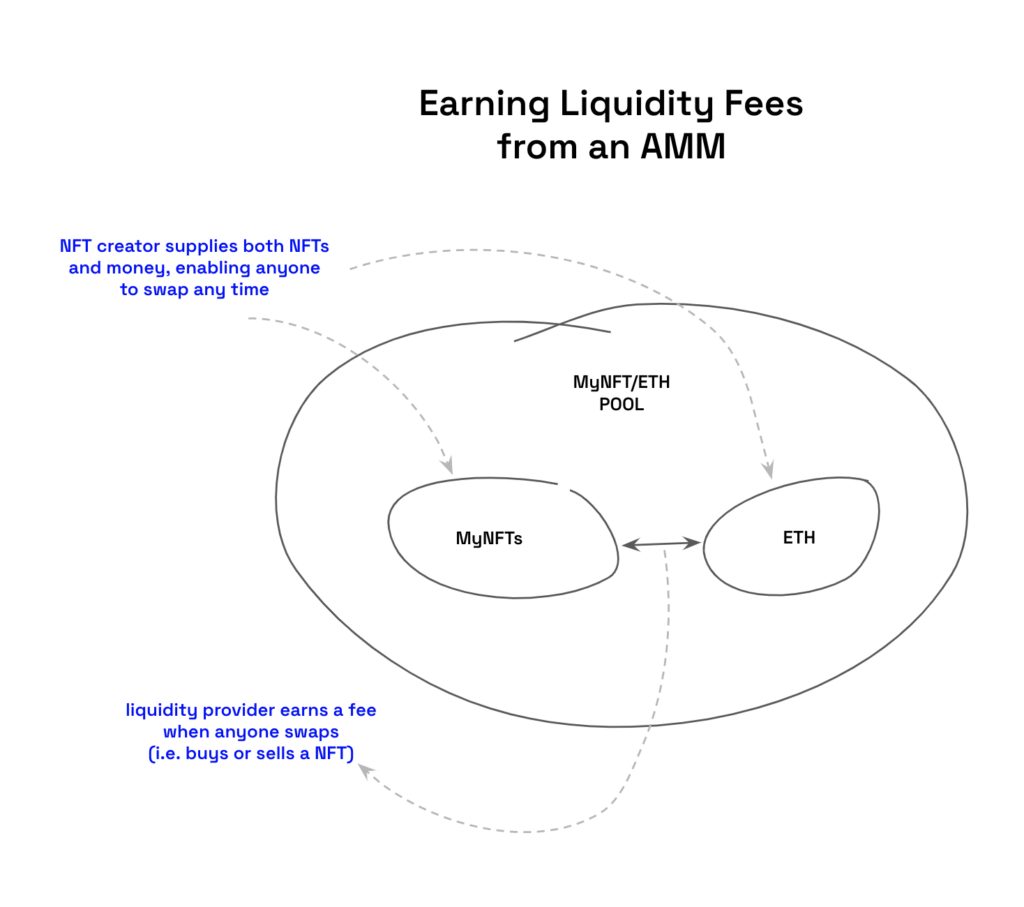

This has been occurring in cryptocurrencies for a few years via AMMs. They’ve been first used for NFTs in the last month. Brand new evolution from web3! 🔔

First, what’s an AMM? Automated Market Maker. Exchanges (eBay or TD Ameritrade) use order books. They make sure there is one buyer that matches one seller, and then they facilitate the matching order.

If you want to buy, you need to have a seller. And vice versa.

AMMs are a web3 invention.

Two assets are loaded into a pool. Let’s say 1000 Apples and 1000 Dollars. That equates to 1 Apple = 1 Dollar.

You, then, can sell your Dollar to buy an Apple from the pool. Or you can sell your Apple to buy a Dollar from the pool. Price adjusts on a x * y = z formula, adjusting the price after every order while enabling anyone to conduct a transaction without the need for a counter-party.

Automated. Market maker. Brilliant!

If you contribute your Apples or Dollars to the pool without taking anything out, you are making it possible for others to buy or sell into the pool and should be rewarded. People who do buy or sell into the pool also pay a small fee for the convenience…and you get a % of the fee as revenue in return for you making it all possible. You are a ‘liquidity provider’ and earn revenue from ‘liquidity fees’. You can take your 🍎 back any time you want, too, and stop taking fees.

Clever creators have recently chosen to sell their newly created NFTs and – instead of keeping the money – automatically shift sales revenue directly into an AMM pool to gaurantee that buyers will have instant liquidity, increasing the buyer’s confidence that they can unload their investment even if nobody wants to buy it. And the creator just collects AMM fees.

🔟 ???

It’s hard to say what will come next. We’ve seen hundreds or thousands of experimental ways to make money just in the last 2 years. WAY more than I listed here.

Many failed. A few held. Others were further innovated on.

✅️ Thats what I’m here for.

I’m seeing models in play that reduce some business expenses 95%. Others that can funnel online traffic ongoing with nearly no additional cost. Others that build energetic communities.

Even most crypto-native folk are missing this stuff. For sure almost all Web 2.0 folk are missing this stuff. If you look at the ocean, it’s easy to be excited or annoyed by the surface – the waves. The headline (aka waves) are distractions. If that’s your source of info, good luck.

That’s why I like to look below the surface layers. To look at where substantive value is being created.

There’s a ton going on. And I’m here for it.

(Featured image created using DALL-E A.I.)