The Digitization of Fine Art

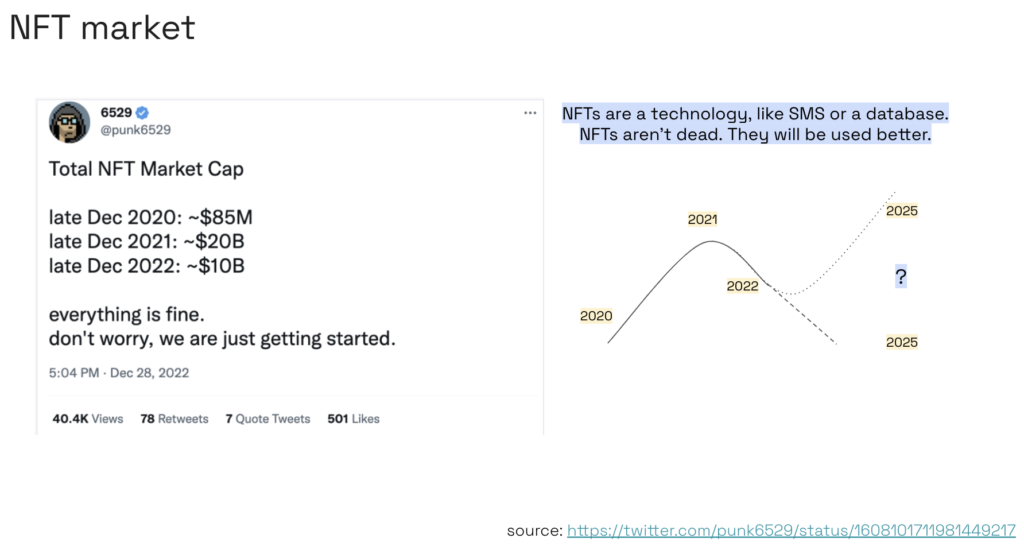

While the general public sentiment seems to be “NFTs dead”, there are sophisticated ways to view the market objectively.

If we’re to replace generalized sentiment with first-principles, we might eventually conclude that NFTs aren’t an asset class. We might conclude they are a technology, akin to text messaging, databases, and other technological underpinnings.

Following said conclusion, our minds shift – value chains are complex beasts. Maybe NFT technology simply serves as part of the value chain. Maybe it is an enabler.

How NFTs Enable Innovation in Fine Art

What makes fine art valuable? Many things, with desirability and scarcity near the top of the list. People desire specific art pieces for certain reasons – maybe because of the artist, or the style, or the medium or some other factor. And clearly collectors pay premiums for scarce art – the Mona Lisa wouldn’t command the price it does if there were a million of originals in circulation.

When scarcity becomes a factor in art collection, proof of authenticity and proof of ownership matter. There’s an entire industry built around proving authenticity and paper trails proving ownership.

Fortunately, blockchain technology is an ideal solution to handle provenance. NFTs take a very complex and expensive process of proving authenticity and ownership and trivializes into an inherent attribute of the technology. When fine are is created on the blockchain the right way, provenance is inherent. Absolute certainty with no 3rd party support required.

Transferability also matters. The fine art market is a massive market. And most of the art traded is physical art that, if purchased, needs to be carefully transported. This is a hinderance. The market for potential buyers decreases due to the complexity and risk of global logistics. Wouldn’t it be nice if fine art could be transported across the world, to any location regardless of borders, instantly, cheaply, with 100% likelihood of success and without risk of degradation? Blockchain does that.

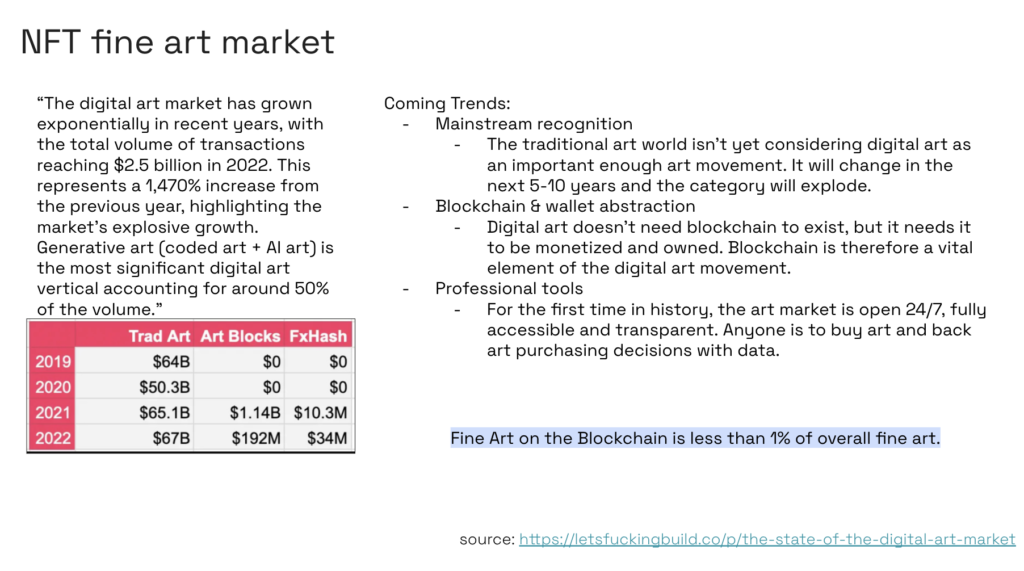

A Look at the Markets

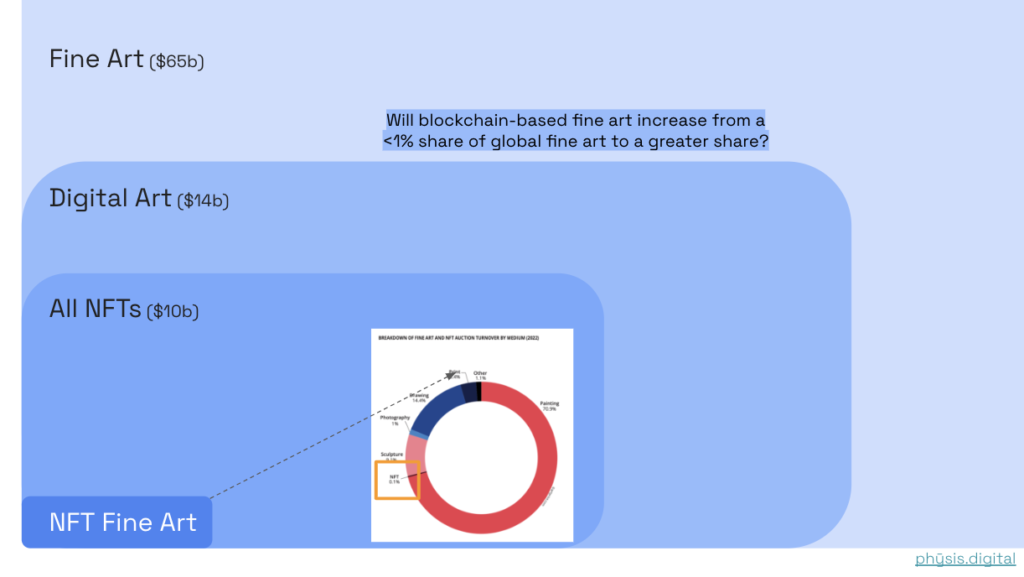

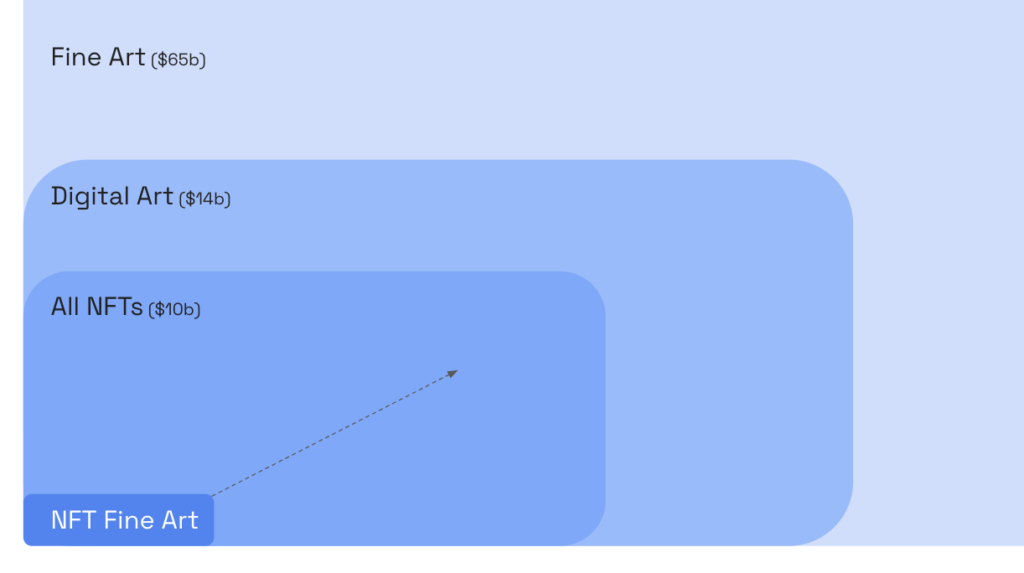

If we look at 4 distinct markets, we see a path forward for the digitization of fine art.

The fine art market turnover alone was $16.5b in 2022.

Fine Art’s revenue alone is larger than the digital art market capitalization, which is bigger than the entire NFT (which isn’t actually an asset class imo), which is massively larger than NFT Fine Art’s market cap. NFT Fine Art’s size is less than 1% of Fine Art’s revenue. Less than 0.01% of fine art’s market size.

Inspecting Each Market

These slides don’t require much commentary.

Fine art is growing. There are complexities with authenticity, ownership and transport.

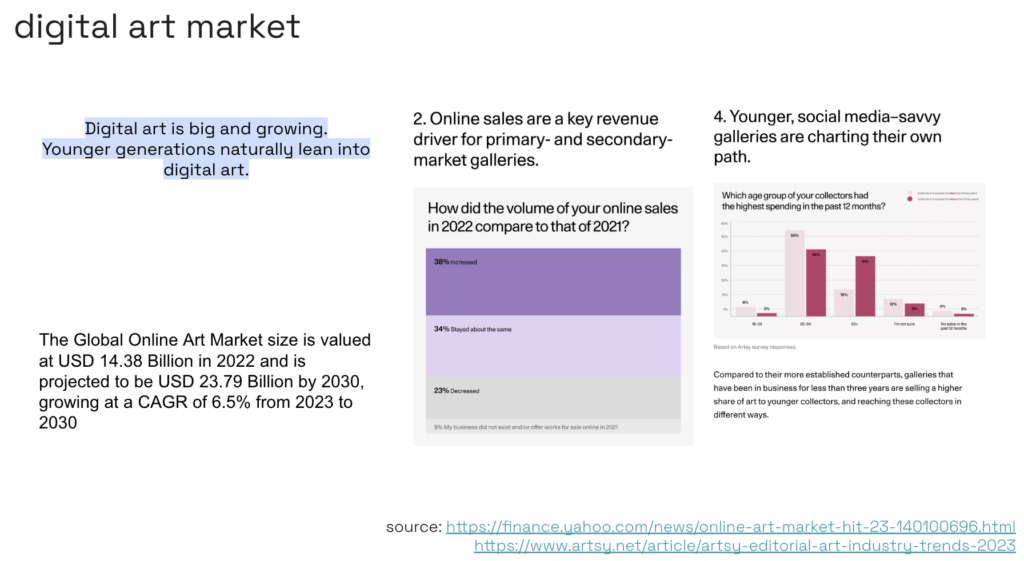

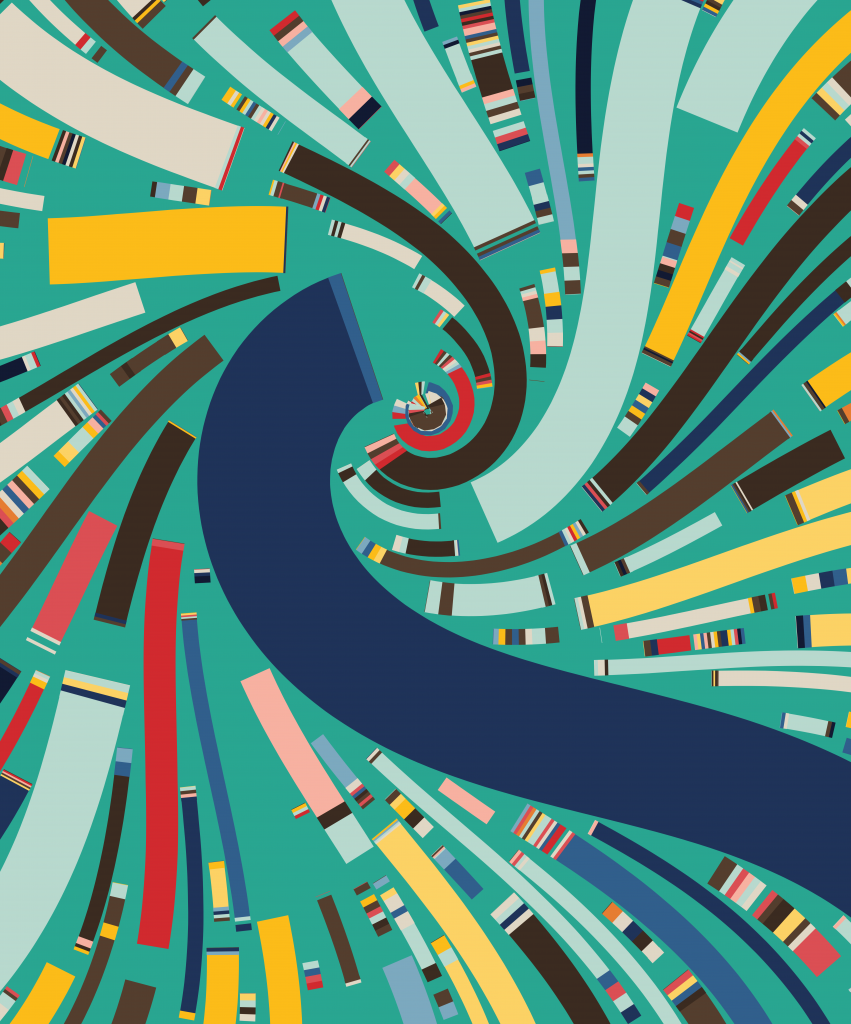

Top artists are adopting digital. Digital also has complexities with authenticity and ownership.

NFT are growing. NFTs are down 50% from highs. They are up almost infinitely from only a few years prior. Is it the normal swings of a maturing market or a useless technology that is worth $0?

Fine Art and blockchain create a combination of a historically strong use case with ideal technology evolution.

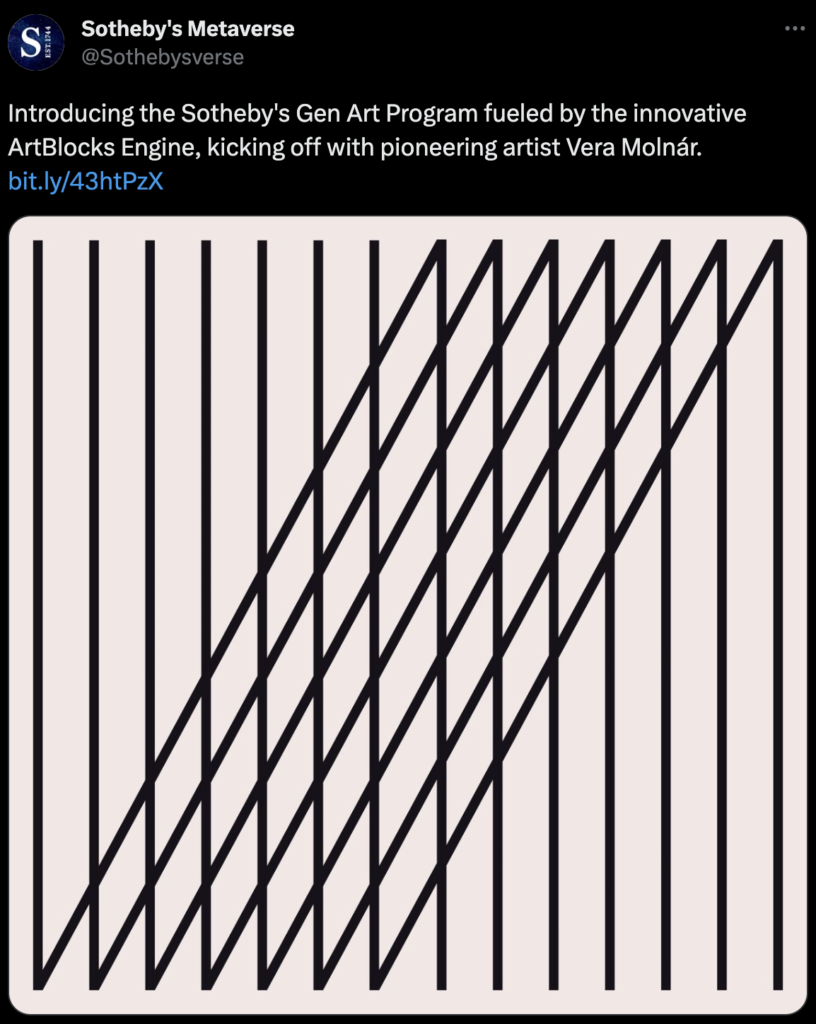

Premier Auction Houses Are Already Involved

Recently, a liquidation of defunct venture capitalist firm Three Arrows Capital’s art inventory fetched $12m. It was headlined by a single piece, created by Dmitri Cherniak, that was purchased for $7m.

New art is being created, too. Sotheby’s has a current art drop available for sale. Using a Dutch Auction format, it’s likely that 500 pieces will sell out for a minimum of $2m total, possibly 3-4x more.

Where is it all Headed?

Honestly, who knows.

That said, I know where my bet is placed.