Crossing the Chasm: Building a web3 Portfolio

Cryptocurrencies, popularized by Bitcoin, seem to be on the cusp of breaking beyond mainstream awareness and into mainstream acceptance.

For the last decade, crypto was largely ignored or scoffed at. During this same timeframe, most people understood Bitcoin to basically represent crypto.

Also during this time frame, a lot has been happening.

- Blockchain technology realized significant innovations

- World class talent moved into the space

- New economics have been explored

This amounts to web3 being much broader, deeper and more relevant than people understand.

People are attracted to crypto for different reasons. One of those reasons is to speculate. To make money by trading or investing.

Given that we’re about to “cross the chasm” for blockchain user adoption, it’s not surprising that friends have been showing interest recently.

This document might help provide some high-level guidance.

Let’s take a quick look at where we are.

Early Adopters are flowing in. Over the next 2-6 years, we’ll see the Early Majority start to show up.

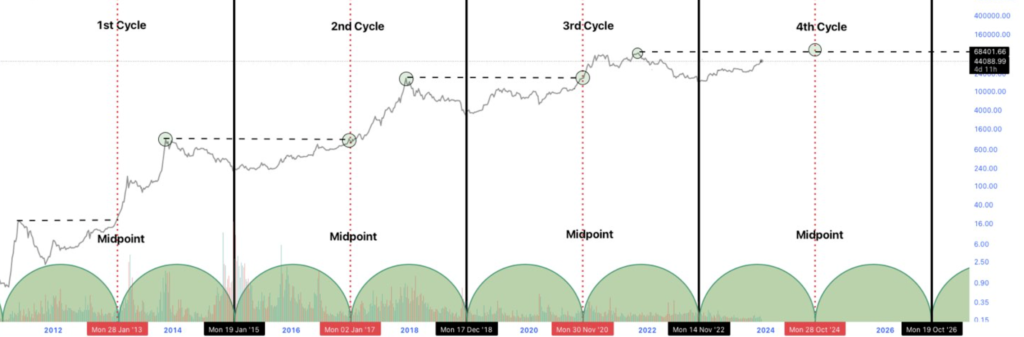

I’ll probably never give advice as to “when” to enter the market, nor whether or not to buy. Those decisions are on you. That said, I trade patterns. They represent group psychology, which is highly predictable. Crypto has followed a consistent pattern since it’s inception. Each 4 years, a rush of people and money come into crypto, then a bunch leave. Then it happens again. Each cycle, a few more people stay, a little more money stays. Meanwhile all of the good technology and economics continuously evolve regardless of the 4-year cycle. This is why I’m long-term bullish and still sell and re-buy each 4 years. The fundamentals are up-only, while humans are emotional.

Even though the market experiences 4-year cycles, the adoption curve is probably up-only. And there’s a lot of up yet to go.

Build Your web3 Portfolio

I’ll start with this – I typically hold 0 or little Bitcoin. I hold lots of other stuff.

Building a portfolio can be as easy as buying Bitcoin via an ETF and ignoring it the rest of your life and it can be as complex as becoming a full-time day-trader. Or anything in between.

This means that the path you go down is uniquely yours. Look to others for ideas, then refine them into your personal strategy.

Here are some considerations as you begin contemplating what type of path you will choose to walk down.

Consideration #1: Your Goals

Your goals affect your decisions pertaining to:

- categories to engage in (gaming, infrastructure, DePIN, DeFi, SocialFi, etc)

- time horizon to plan for (quick flip, retirement, save for large purchase, etc)

- entry price (start with $0, $100, $10k, $1m, etc)

- time commitment (will you be full-time, weekend warrior, check in each quarter, etc)

- portfolio strategy (high or low risk, 50+ tokens or just 3, etc)

My personal goal is to build retirement savings and supplement our lifestyle. This leads me to considering the standard 4-ish-year macro crypto cycles and short cycles within each bull market.

I started with what I started with. Now the focus is on growing it’s value. To maximize retirement savings, I intend to hold crypto for the long-haul based on my perspective on it as an asset class, which means long-term accumulation is a part of my strategy. Recognition of the 4-ish-year macro crypto cycle keeps me focus on decisions within that timeframe to avoid the standard 80%+ drawdown each macro cycle and to capture profits during in each run to satisfy the lifestyle goal.

Consistent growth is also importing to achieve my goals, so I choose to manage a broad crypto portfolio that covers multiple categories and multiple risk profiles to dilute the impact any one coin or category can have on my portfolio. I don’t want to risk-it like a casino gambler. I want to diversify (within the crypto sector) to even out the highs and lows of each individual category.

Your goals are probably different. So will be your strategy.

Consideration #2: Your Interests

I love studying new and disruptive technology. It’s fun for me to try and understand what’s going on, which parts are impactful and sustainable vs which are hype and vapor. It’s fun to figure out who might use what, why and how.

Gaming is also interesting to me. I’ve been a lifelong gamer and uncommon (sometimes unwelcome) proponent of more screen time (the right kind) for kids.

My mind thinks like an architect and engineer. I like to understand how structure at a base layer empowers creativity as new layers are built above it – and how to expedite and optimize the new layers. This leads me into infrastructure category.

Follow your nose. Focus on categories you love and already naturally give your attention to.

Consideration #3: Your Style

Both trading and investing are very personal things.

It’s important to “craft your strategy” and avoid the trap of “finding the best strategy”.

Someone on a long time-horizon and (relatively) low risk tolerance will utilize a different strategy than someone who wants to flip for new car. And there’s a spectrum of unique strategies in-between. Whether you execute your own strategy or delegate it to a financial advisor, it’s important that the strategy fits your style – if you are a tinkerer, you might not want an advisor fully managing your portfolio. If you are anxious and get disturbed by numbers going up and down, it’s best not to utilize an active strategy.

My style is a bit of a surfer style. I identify trends, then look for confluence between two trends. Like two waves joining up, the confluence of two trends creates explosions in demand (aka adoption and valuation).

To align with my style, my strategy includes researching lots of tokens briefly to organize them into trends and themes. With trends and themes, I can start to see where two trends might bump into each other (and whether that’ll be good or bad).

I like learning “as I go” a bit – I’m not one to read an instruction manual en toto before using a device. So I hold a lot of tokens. Having a financial interest in many tokens ensures my attention is on those tokens and it expedites my learning in selected themes within chosen trends.

These two style aspects shape my strategy into a cohesive system.

Furthermore, energy management is important to me. This style allows me to manage my portfolio in alignment with my personal energy. Sometimes I feel up and energetic and I research more. Other times I feel down and lethargic and I let it ride or prune laggards.

Your style is certainly different than mine. So will be your strategy.

Conclusion

These serve as a few initial buildings blocks as you’re thinking about getting into web3.

Whereas the common questions sent to me are focused on assets (which token?), my responses are almost always related to your mindset.

When you learn to steer the ship, the eventual destination is a side effect of an incredible journey.